Each year the Mergers & Acquisitions Committee of the American Bar Association prepares a detailed study entitled the Canadian Private Target M&A Deal Points Study. This study covers a sample of 101 publicly available acquisition agreements and covers transaction values of from less than $5,000,000 to greater than half a billion dollars. This is a must-read study for M&A professionals. In this two part blog I will be summarizing what I believe are the highlights of the study. This is part two of two.

REPRESENTATIONS AND WARRANTIES

The representations and warranties section of any M&A purchase agreement is often the longest section and the section that a buyer and seller spent the most time negotiating. Deals sometimes don’t get past the negotiation of representations and warranties. It is therefore crucial that an M&A advisor have proven strategies that can be applied to negotiating these, otherwise you will not get the best terms or worse yet – your deal will collapse.

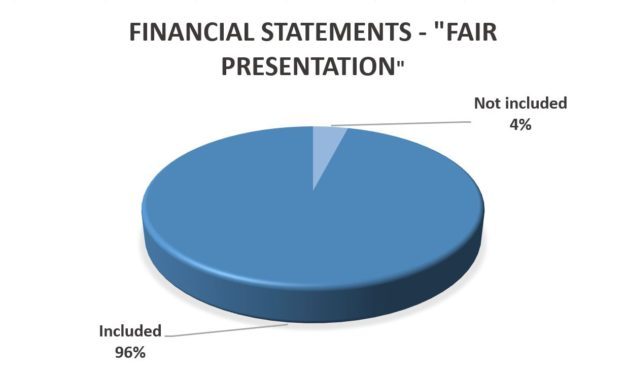

Financial Statements – “Fair Presentation” Representation

Sample Clause:

“Financial Statements. The financial statements fairly present the financial condition and the results of operations, changes in shareholders’ equity and cash flows of the Target as at the respective dates thereof and for the periods referred to in such financial statements, all in accordance with GAAP.”

The study shows that 96% of purchase agreements contained a “Fair Presentation” representation. Where this representation was included it was not qualified to include “all in accordance with GAAP” in 81% of the agreements. These statistics are consistent with prior years.

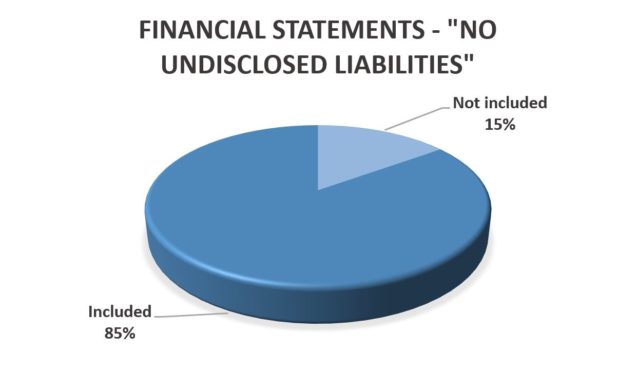

Financial Statements – “No Undisclosed Liabilities” Representation

Sample clause:

“No Undisclosed Liabilities. The Target has no liability except for liabilities reflected or reserved against in the Balance Sheet and current liabilities of Target’s ordinary course of business since the date of the Interim Balance Sheet.”

The study shows that 85% of purchase agreements contained a “No Undisclosed Liabilities” representation. This representation was rarely “Knowledge” qualified, occurring only 7% of the time. These statistics are consistent with prior years. This means a that seller’s are responsible for ensure full disclosure with respect to the liabilities of their company.

Compliance with Laws

Sample clause:

“Compliance with laws. The business of the Target has been and is being conducted in compliance with all applicable laws.”

- The study shows that 96% of purchase agreements contained a “Compliance with Laws” representation. This representation, however, has a number of carve outs that can be applied. For example:

- Notice of violation of Laws carve out: included in 59% of agreements (compared to 21% in 2012)

- Notice of investigation of non-compliance with laws carve out: included in 20% of agreements (compared to 0% in 2012 and 4% in 2014)

- Covers present and past compliance: included in 50% of agreements

- Knowledge qualification: included in only 13% of agreements (compared to 23% in 2012)

Full Disclosure

Sample clause:

“Full Disclosure. No representation or warranty or other statement made by the Target in this agreement or otherwise in connection with the contemplated transactions contains any untrue statement of material fact or omits to state a material fact necessary to make the statements in this agreement not misleading”

The study shows that a Full Disclosure representation was not included in 64% of agreements and in the majority of the times it was included it wasn’t knowledge qualified. Worth noting is that this is showing a seller bias because on 2012 the inclusion rate was 52%. This may be due to the fact that buyers and their advisors are conducting more due diligence on the Target or because there is a shift to more seller favourable language for this clause.

COVENANTS

Covenants are generally provided by both the purchaser and the seller in an M&A agreement. Covenants are simply agreements to do something and they can apply to durations of time both before closing (interim covenant) and after closing (post-closing covenant) of the transaction. Covenants can be “negative” – which act to prohibit certain actions, or “positive”, which act to require certain actions on behalf of the person giving the covenant.

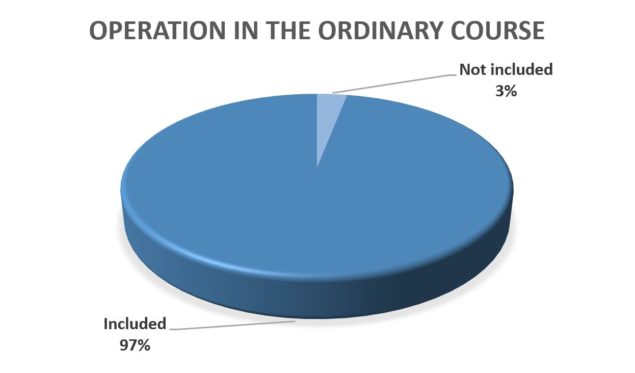

Operation in the Ordinary Course

Sample Clause:

“Operation in the Ordinary Course. During the Interim Period the Business shall have been conducted in the ordinary course of business consistent with past practice and no member of the Target shall have entered into any transaction or made, declared or effected any extraordinary payment, dividend, bonus, loan, distribution or similar payment, which was not in the ordinary course of business consistent with past practice.”

This is an interim covenant that applies to actions of the seller during the period of time prior to closing thus ensuring for the purchaser that the seller will not operate the business differently than in the manner that has been represented to the purchaser. This clause was contained in 97% of the sampled agreements.

No Shop/No Talk

Sample Clause:

“No Shop/No Talk. Between the date of this Agreement and the earlier of the Closing and the termination of this Agreement, neither the Target nor its representatives shall (i) solicit, initiate, consider, encourage or accept any proposal or offer in respect of the business or (ii) participate in any discussions, conversations, negotiations or other communications regarding, or furnish to any other person any information with respect to, or otherwise cooperate in any way, assist or participate in, facilitate or encourage the submission of any proposal that constitutes or could reasonably be expected to lead to a proposal or offer in respect of the business.”

Essentially this clause prevents the seller from finding a new buyer while the seller is negotiating with the purchaser. The purpose of this clause is to protect the purchaser and the investment (e.g. legal fees, accounting fees, travel costs, and most importantly – time) they are making in exploring the transaction. The study shows that a No Shop/No Talk clause is included in 62% of agreements, which is a large increase since 2012 where it was only included in 42% of agreements.