An interlender agreement is an agreement between or among two or more lenders that stipulates and allocates the priorities between them. In particular, it covers their priorities in the debtor’s collateral and the timing of repayment by the debtor (also known as the Borrower).

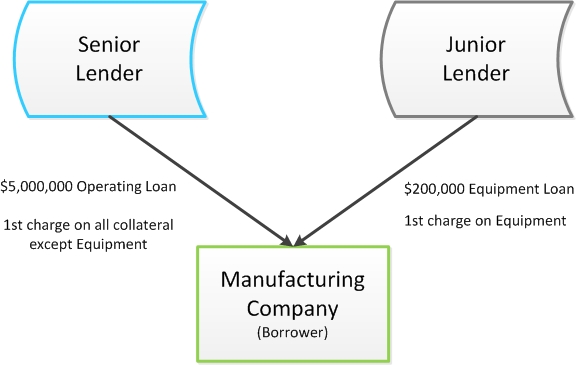

A scenario where an interlender agreement would be appropriate is shown below:

Lenders who enter into this type of agreement often have different levels of risk and exposure – typically the lender who has the larger amount of outstanding loans is referred to as the senior lender and the lender with the least is referred to as a junior or subordinate lender. It is often the senior lender who initiates the implementation of an interlender agreement.

Three Core Terms to an Interlender Agreement

Three core terms are generally negotiated in an interlender agreement:

- Priority among lenders;

- Postponement of security or repayment of debts to the Junior Lender; and

- Standstill of enforcement of the Junior Lender’s security.

These agreements sound complicated but if you break them down into their individual elements they are much easier to understand:

Priority

: to give something more importance over another thing or so that it is done or dealt with first

Postponement

: to decide that something which had been planned for a particular time will be done at a later time instead

Standstill

: a state in which all activity or motion is stopped

Priority. A Senior Lender will want priority (or rank 1st) over all or most of a Junior Lender’s collateral. This is because it is important for a Senior Lender to be confident that if it is to enforce its security against the Borrower’s collateral that it is going to be able to get its money out first. A Senior Lender can require priority over specific assets and/or over the repayment of debt by the Borrower. A Junior Lender may seek to limit the dollar value of the Senior Lender’s priority or negotiate priority over specific collateral. In the scenario above, the Junior Lender lent money to the Borrower to acquire equipment and has negotiated priority over that equipment.

Postponement. Depending on the bias between the Senior Lender and the Junior Lender, the Senior Lender may require the Junior Lender to postpone the collection of all or a part of their loans to the Borrower. In other cases a postponement may not be triggered until certain events occur (e.g. an event of default by the Borrower under the Senior Lender’s loans will permit the Senior Lender to freeze further payments by the Borrower under the Junior Lender’s loans). Junior Lenders will often try to negotiate the shortest postponement period possible while the Senior Lender will want to extend the postponement period for as long as possible.

Standstill. With a standstill provision, the Senior Lender will require the Junior Lender to delay enforcing its security against the collateral of the Borrower for an agreed upon period of time. This gives the Senior Lender time to assess the situation and consider its options (one of which may be taking out the Junior Lender). This is often considered a reasonable request because the Senior Lender has much more to lose if the Junior Lender enforces its security prior to the Senior Lender doing the same. In the scenario above, the Senior Lender has a risk exposure of $5,000,000 versus the Junior Lender’s risk exposure of $200,000. Assuming for the purposes of this example that the equipment which the Junior Lender has priority over is essential to the operations of the manufacturing facility, it would be safe to say that allowing the Junior Lender to enter the facilities and seize the manufacturing equipment would risk shutting down the entire operations of the Borrower and therefore limit or eliminate the Borrower’s ability to generate revenues and pay down its debts to the Senior Lender. As you can see from this example, this would cause much more damage to the Senior Lender than to the Junior Lender. Preventing these costly stoppages or interruptions is one of a number of reasons why the Senior Lender requires a standstill provision in an interlender agreement. Junior Lenders will often try to negotiate the shortest standstill period possible while the Senior Lender will want to extend the standstill period for as long as possible.

Conclusion

Interlender agreements come in many forms but generally focus on the same core elements – Priority, Postponement and Standstill. A poorly drafted interlender agreement could cause a tremendous amount of loss and damage to the Senior Lender as well as to the Borrower (e.g. unnecessary production stoppages), or unfairly handcuff the Junior Lender.

Although interlender agreements are often biased in favour of the Senior Lender, they should not be viewed as being solely for the Senior Lender’s benefit – if properly negotiated, there can also advantages and benefits for each of the Junior Lender and the Borrower. Lenders (both Senior and Junior) should almost always consult with their legal counsel before signing an interlender agreement as there is much more to lose than to gain if it are not properly drafted!