This is a must read for any entrepreneur who is looking to sell their business or is looking to purchase a business.

TAKEAWAY:

Sellers prefer a share sale. Buyers prefer an asset sale.

The structure that is best for the buyer is often not best for the seller.

Share sales often result in lower valuations and asset sales often result in higher valuations.

Buyers and sellers of a business are often faced with unique challenges and conflicting interests when it comes to structuring a private company transaction. The most common and by far the most negotiated decision is whether to structure the transaction as an asset sale or a share sale, or a hybrid of the two.

There is a great deal of literature on the subject of structuring a transaction of this type, including entire manuals and textbooks – what I’ve summarized below are some of the more common and important issues to consider when negotiating the structure of a transaction and ultimately the price paid for the business.

| ASSET SALE | SHARE SALE | |

|---|---|---|

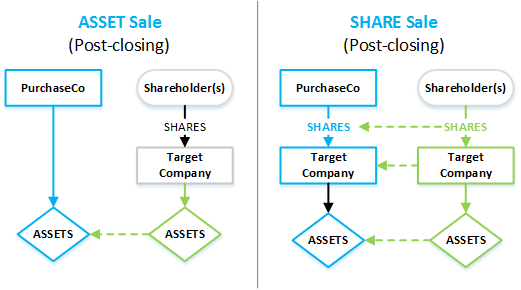

| What happens to the “Company”? | With an asset sale, the target company sells its assets to the buyer company (“PurchaseCo”) that will use those assets to operate the business as an entirely new company, likely under the same name. The ownership of the target company will not change. | With a share sale, the shareholders of the target company sell their shares in that company to PurchaseCo. Upon completion of the transaction PurchaseCo will control the target company. |

| Assets | With an asset sale, PurchaseCo will have the opportunity to cherry pick the assets it wishes to buy. PurchaseCo will typically purchase a substantial majority of the assets of the target company, leaving the less desirable assets with the seller. | With a share sale, PurchaseCo acquires all of the assets by reason of the fact that all assets remain with the target company being acquired. |

| Contractual Obligations | With an asset sale, PurchaseCo will have the opportunity to pick and choose the contractual obligations which it wishes to assume, leaving the less desirable contracts with the seller. | With a share sale, PurchaseCo will typically have the benefit of non-assignable contracts, licences and permits without taking additional steps to obtain third party consents. On the other hand, PurchaseCo will be forced to assume contracts it may not want to assume. |

| Taxes | The sale of assets can lead to negative tax implications for the seller (e.g. recapture of capital cost allowances, profits on inventory).

GST, PST and other transfer taxes (e.g. land transfer tax) are generally paid by PurchaseCo. |

Each shareholder may have the access to their Lifetime Capital Gains Exemption (approx. $800,000) – this means fewer taxes are paid by the seller. |

| Employees | With an asset sale, the identity of the employer changes and PurchaseCo will therefore have the opportunity to pick and choose which employees it wishes to retain and the terms of their employment post-closing. This exposes the seller to severance liabilities on closing of the transaction if the buyer does not offer employment to all employees. | With a share sale, the employee relationships remain unchanged because there is no change in the identity of the employer. There is therefore no requirement to make new offers of employment to employees. |

| Company Debts | With an asset sale, the buyer will pick and choose which debts it wishes to assume and which it requires the seller to retain. This is often factored into the negotiation of the resulting purchase price. | With a share sale, all debts of the target company will be assumed by PurchaseCo as the debts will remain with the target company after closing, which target company is then owned by PurchaseCo. |

| Liabilities | With an asset sale, the buyer can avoid the acquisition or assumption of undesired liabilities, in particular those that may have accrued against the target company prior to closing. | With a share sale, most if not all liabilities of the target company will be assumed by the buyer including undisclosed and contingent liabilities. |

Conclusion

The components that go into the determining the structure of a particular transaction appear on the surface to somewhat simple but they are actually quite complex. There are lawyers, accountants, and other M&A advisors who devote their entire practices to understanding and negotiating these types of transactions. It is therefore important that experienced advisors in this field are engaged.

If you are considering selling your business, one of the first steps you’ll take (well, you should take) is to engage the services of a business broker who will evaluate your business and list it for sale. One mistake that is far too often made is where sellers don’t also engage their legal M&A advisor and tax M&A advisor at this early stage or even prior to engaging a business broker. This is because both a legal review and a tax review of your business are essential steps to avoiding critical mistakes when selling your business, as well as organizing your company and/or shareholdings to get the maximum value for your business.